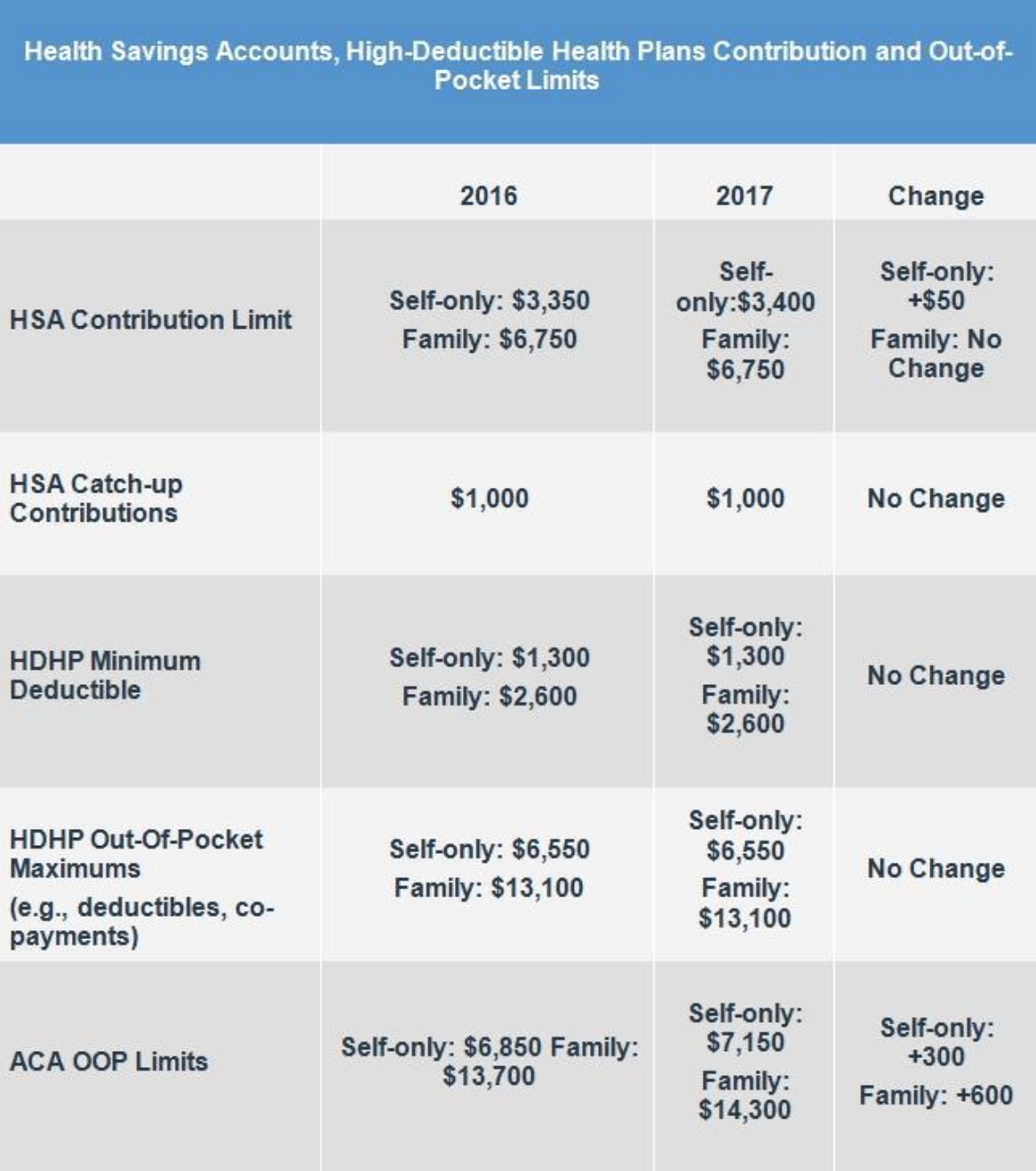

The Internal Revenue Service (IRS) recently released the inflationary adjustments for 2017 High-Deductible Health Plan (HDHP) and Health Savings Account (HSA) plans. Generally, the limits for 2016 and 2017 will remain the same, with the exception of the self-only HSA maximum contribution limit.

The Affordable Care Act (ACA) Out-Of-Pocket (OOP) and cost-sharing limits are other threshold amounts employers should be aware of; those limits are adjusted by the Department of Health and Human Services (HHS). These limits may differ slightly from each other (i.e., the ACA cost-sharing limit is higher than the OOP for HDHPs). In order for a plan to qualify as an HDHP, it must comply with the lower OOP maximum limit. (For 2017 that limit is $6,550 for self-only and $13,100 for family plans, but keep in mind that individual deductibles must be embedded, meaning each individual covered on a family HDHP can only be required to meet the self-only deductible).

Employers with an HDHP and an HSA should ensure their plans are compliant with the new limits by the first day of their plan year in 2017.