Employers must offer health insurance or pay a penalty

Employer mandate overview

Employers must offer health insurance that is affordable and provides minimum value to 95% of their full-time employees and their children up to the end of the month in which they turn age 26, or be subject to penalties. This is known as the employer mandate. It applies to employers with 50* or more full-time employees, and/or full-time equivalents (FTEs). Employees who work 30 or more hours per week are considered full-time.

Employer mandate requirements

Affordable coverage

Coverage is considered “affordable” if employee contributions for employee-only coverage do not exceed a certain percentage of an employee’s household income (9.86% in 2019 and 9.78% in 2020).

Based on IRS safe harbors, coverage is affordable if the cost of self-only coverage is less than the indexed percentage of the following:

- Employee’s W-2 wages (reduced by any salary reductions under a 401(k) plan or cafeteria plan)

- Employee’s monthly wages (hourly rate x 130 hours per month),

OR - Federal Poverty Level for a single individual

In applying wellness incentives to the employee contributions used to determine affordability, assume that each employee earns all wellness incentives related to tobacco use, but no other wellness incentives.

A plan provides “minimum value” if it pays at least 60% of the cost of covered services (deductibles, copays and coinsurance). The U.S. Department of Health & Human Services has developed a minimum value calculator that can be used to determine if a plan provides minimum value.

Employer mandate penalties

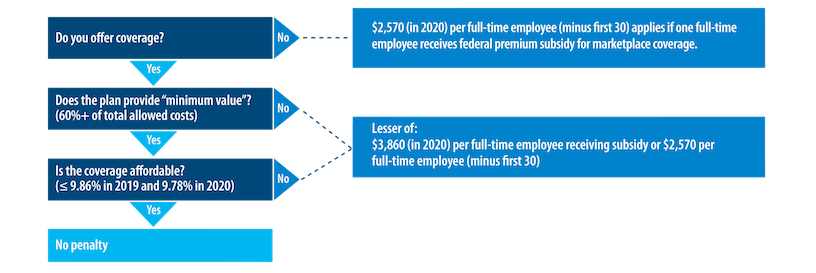

This graphic summarizes the coverage requirements and the penalties that apply if any full-time employee purchases coverage on the Marketplace and receives a federal premium subsidy.

Additional details on the Employer Mandate

Employers with 50 or more full-time and/or FTE employees must offer affordable/minimum value medical coverage to their full-time employees and their dependents up to the end of the month in which they turn age 26, or they may be subject to penalties. The amount of the penalty depends on whether or not the employer offers coverage to at least 95% of its full-time employees and their dependents.

- Employers who fail to offer coverage to at least 95% of full-time employees and dependents may be subject to a penalty of $2,320 per full-time employee minus the first 30.

- Employers who offer coverage may still be subject to a penalty if the coverage is not affordable or does not provide minimum value. This penalty is the lesser of either $3,480 per full-time employee receiving a federal subsidy for coverage purchased on the Marketplace, or $2,320 per full-time employee minus the first 30.

Employers must treat all employees who average 30 hours a week as full-time employees.

Dependents include children up to age 26, excluding stepchildren and foster children. At least one medical plan option must offer coverage for children through the end of the month in which they reach age 26. Spouses are not considered dependents in the legislation, so employers are not required to offer coverage to spouses.

Assume each employer has 1,000 full-time employees who work at least 30 hours per week.

- Employer 1 currently offers medical coverage to all 1,000 and their dependents. The company is considered to offer coverage since it offers coverage to more than 95% of its full-time employees and their dependents.

- Employer 2 currently offers medical coverage to 800 full-time employees and their dependents. The company will need to offer coverage to 150 more full-time employees and their dependents to meet the 95% requirement to be treated as offering coverage.

- Employer 3 has 500 full-time, salaried employees who are offered coverage and 500 full-time hourly employees who are not offered coverage. The company will need to offer coverage to at least 450 hourly employees (and their dependents) to meet the 95% requirement to be treated as offering coverage.

- Employer 4 offers coverage to 950 full-time employees and their dependents. Only 600 of those employees actually enroll in coverage. The company is compliant no matter how many employees actually enroll in affordable coverage that offers minimum value.

The regulations allow various calculation methods for determining full-time equivalent status. Because these calculations can be complex, employers should consult with their legal counsel.

- Full-time employees work an average of 30 hours per week or 130 hours per calendar month, including vacation and paid leaves of absence.

- Part-time employees’ hours are used to determine the number of full-time equivalent employees for purposes of determining whether the employer mandate applies.

- FTE employees are determined by taking the number of hours worked in a month by part-time employees, or those working fewer than 30 hours per week, and dividing by 120.

Here are some considerations to help determine how part-time and seasonal employees equate to full-time and FTE employees.

- Only employees working in the United States are counted.

- Volunteer workers for government and tax-exempt entities, such as firefighters and emergency responders, are not considered full-time employees.

- Teachers and other education employees are considered full-time employees even if they don’t work full-time year-round.

- Seasonal employees who typically work six months or less are not considered full-time employees. This includes retail workers employed exclusively during holiday seasons.

- Schools with adjunct faculty may credit 21/4 hours of service per week for each hour of teaching or classroom time.

- Hours worked by students in federal or state-sponsored work-study programs will not be counted in determining if they are full-time employees.

Employers may not impose enrollment waiting periods that exceed 90 days for all plans beginning on or after January 1, 2014. Shorter waiting periods are allowed. Coverage must begin no later than the 91st day after the hire date. All calendar days, including weekends and holidays, are counted in determining the 90-day period.

U.S.-issued expatriate plans meet the employer mandate.

Effective July 16, 2014, the employer mandate no longer applies to insured plans issued in the U.S. territories (Puerto Rico, the U.S. Virgin Islands, Guam, American Samoa and the Northern Mariana Islands). A territory may enact a comparable provision under its own law.

All applicable large employers are required to file an annual report that ensures compliance with the employer mandate. The reporting will include information on all employees who were offered and accepted coverage, and the cost of that coverage on a month-by-month basis.

Each year, public Marketplaces should send notices to employers that may owe a penalty for not complying with the employer mandate. These notices will alert employers if any of their employees received a subsidy through the Marketplace.

Employers that receive these notices will have 90 days to file an appeal if they believe the eligibility determination was made in error. It’s important that employers maintain documentation and records to provide proof of compliance with the employer mandate.

Read more about the employer notice process from the Centers for Medicare and Medicaid Services.

Employer mandate penalty amounts and processes

Examples of employer penalties

| Employer | Trigger | Penalty |

|---|---|---|

| 500 full-time employees

No coverage offered |

One employee purchases coverage on the Marketplace and is eligible for a federal premium subsidy | $2,320 per full-time employee, minus the first 30 employees

500 – 30 = 470 employees 470 x $2,320 = $1,090,400 penalty |

The penalty is the lesser of the two results, as shown in this example.

| Employer | Trigger | Penalty |

|---|---|---|

| 1,200 full-time employees

Employer offers coverage, but coverage is not affordable and/or doesn’t provide minimum value |

The penalty is triggered if one employee purchases coverage on the Marketplace and receives a federal premium subsidy

250 employees purchase coverage on the Marketplace and are eligible for a subsidy |

Lesser of $2,320 per full-time employee, minus the first 30 employees, OR $3,480 per full-time employee receiving a federal premium subsidy

1,170 x $2,320 = $2,714,400 penalty 250 x $3,480 = $870,000 penalty (lesser penalty applies) |

Here is a snapshot of the penalty assessment process:

Employer offers health coverage compliant with the employer mandate

|

| Employer reports coverage offer and respective data during the applicable tax season |

| Marketplace reports Minimum Essential Coverage data on employees, including subsidy information |

IRS sends Letter 226J, with an Employer Shared Responsibility Payment assessment based on the data they have processed

|

| IRS sends Notice 220J, confirming the final penalty amounts owed, which could state no amount is owed after final audit review. |

If an employee receives subsidized coverage, the employer should be notified by the public Marketplace. The employer will then be provided an opportunity to respond and appeal if the employee was offered coverage that meets the minimum value and affordability standards.

Once the IRS has received individual tax returns and employer reporting for a given calendar year, it may determine that an employer did not meet its employer mandate requirements and is subject to a financial penalty, known as the Employer Shared Responsibility Payment (ESRP). The IRS will send the employer an IRS Letter 226J.

Any employer who receives a 226J letter should take immediate action to respond to the IRS. The employer has 30 days to respond with documentation and corrected reporting data (if applicable). Doing this may help the employer reduce or eliminate the ESRP assessed.

After the employer responds with documentation of corrected data previously reported on the Forms 1095-C, the IRS will complete their review and send a Notice 220J to the employer. This notice confirms the final penalty amounts being charged, by month. The Notice 220J may also indicate that no penalty is being charged based on the IRS’s review of any data or documentation provided by the employer in response to the initial Letter 226J.

Read more about employers’ options on the IRS web page, Employer Shared Responsibility Payment Q&As, questions 55-58.

Companies that have a common owner are combined for purposes of determining whether they are subject to the mandate. However, any penalties would be the responsibility of each individual company.

* Before January 2016, employers with 50-99 employees were not required to offer coverage, and employers with 100 or more complied if they offered coverage to at least 70% of their full-time or FTE employees.