These limits apply to in-network out-of-pocket costs for most health plans:

Cost-sharing limits overview

The Affordable Care Act (ACA) requires limits for consumer spending on in-network essential health benefits (EHBs) covered under most health plans. These are known as out-of-pocket (OOP) maximum limits.

OOP maximums include deductibles, copays, and coinsurance costs paid by consumers. They do not include health plan premiums or out-of-network costs.

OOP limits apply to most health plans. Specifically, they apply to all non-grandfathered individual and group plans, regardless of size or whether the plan is insured or self-funded.

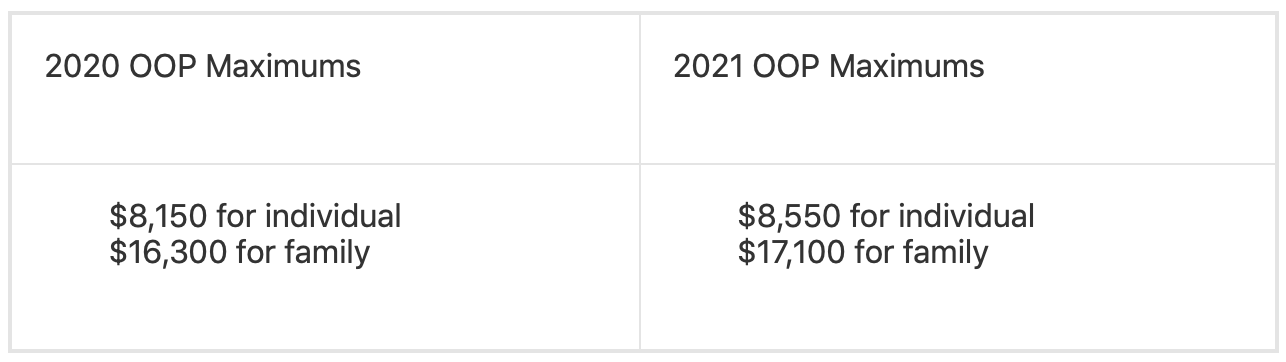

Annual OOP maximum limits

The in-network OOP maximums are adjusted annually. Current amounts are:

Embedded individual OOP maximum in family plans

Effective Jan. 1, 2016, most health plans cannot allow any individual, including those with family coverage, to spend more than the individual OOP maximum established under the ACA. This is commonly referred to as an “embedded” individual OOP maximum.

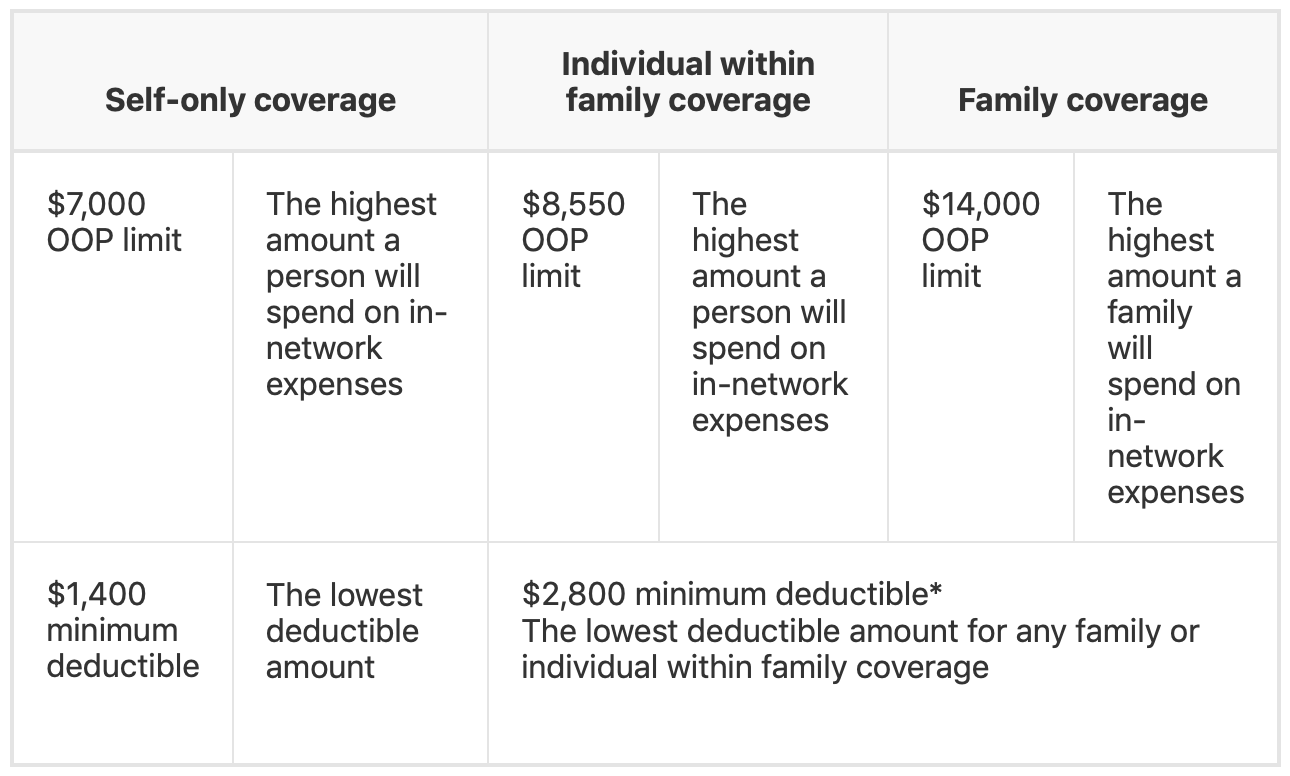

Additional rules for Health Savings Account (HSA) plans

In addition to the ACA cost-sharing limits, HSA-compatible high-deductible health plans (HDHPs) must follow additional Internal Revenue Service (IRS) rules. These rules require plans to have minimum deductible amounts and maximum OOP limits that differ from the ACA OOP limits.

This chart combines the 2021 ACA and IRS rules for HSA-compatible HDHPs:

* There is not a stated IRS minimum deductible for individuals with family coverage. However, if a family plan has a separate individual deductible amount for individual family members, that amount must be at least as high as the ACA minimum family deductible.