Each year the IRS announces updates to contribution limits for Flexible Spending Accounts (FSA), Health Savings Accounts (HSA), Health Reimbursement Arrangements (HRA), and other tax-advantaged accounts. Here’s a look at what’s changing in January 2025.

| Contribution Limits | 2024 | 2025 |

|---|---|---|

| Health FSA: Max Contribution Limit | $3,200 | - |

| Health FSA: Rollover Max | $640 | - |

| DCFSA: Max Contribution Limit | $2,500/$5,000 | - |

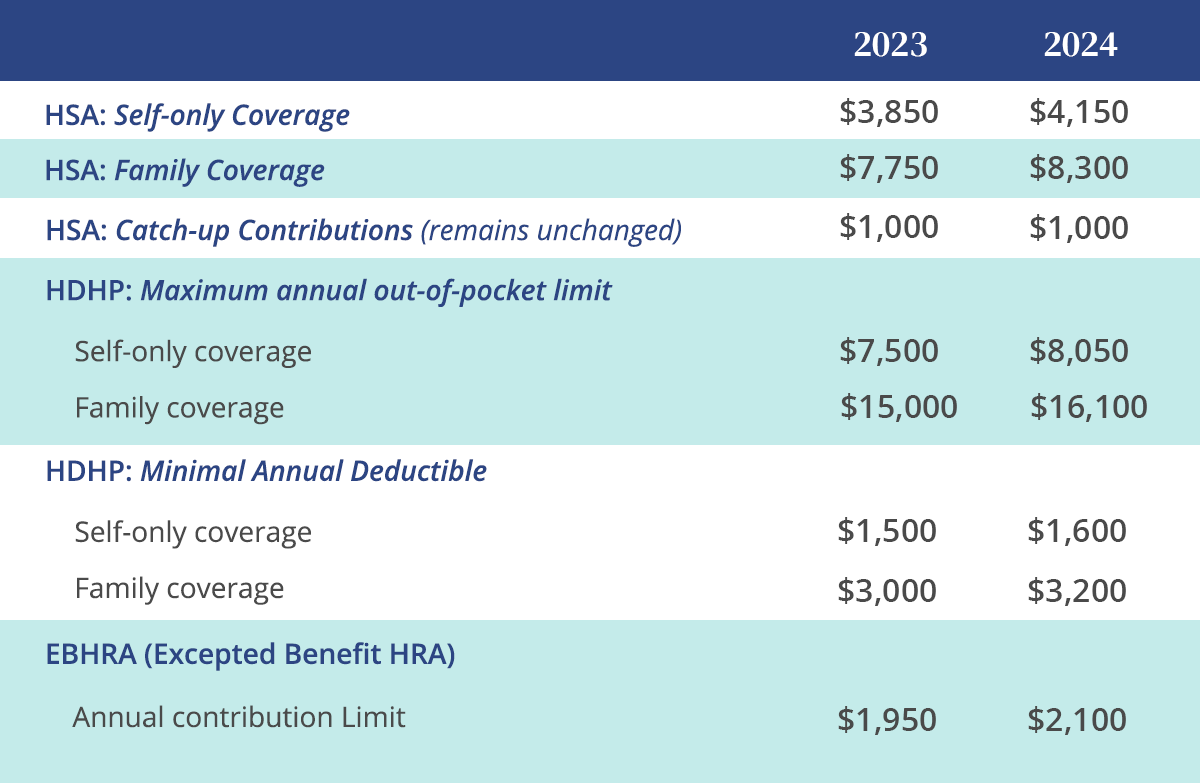

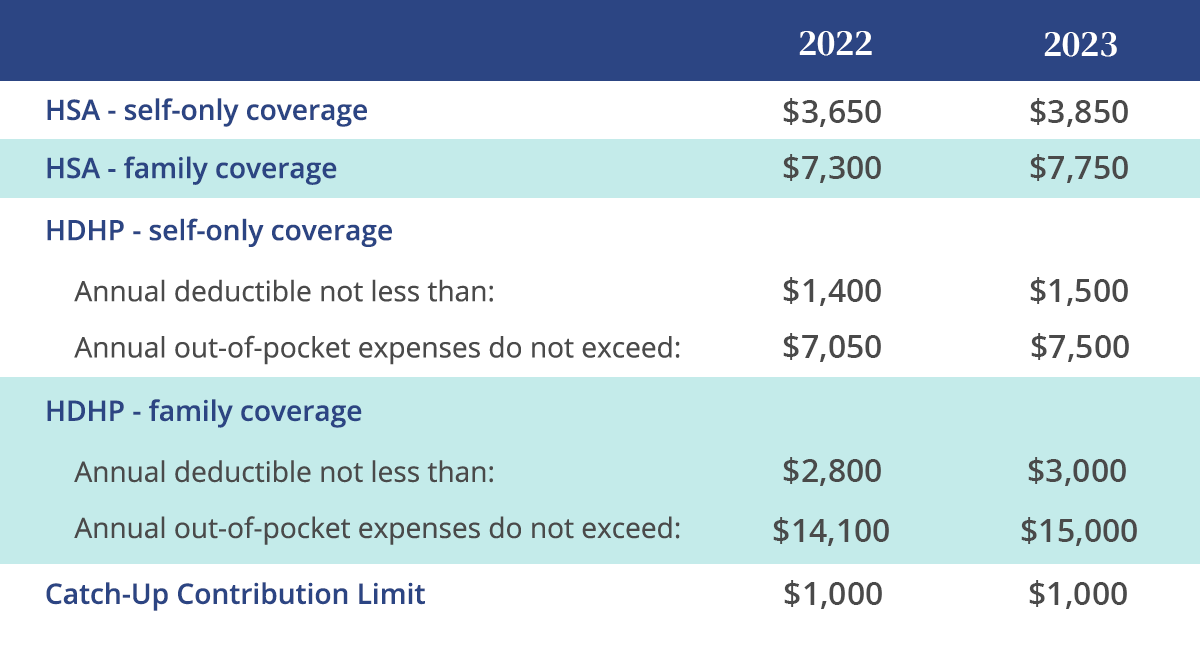

| HSA: Max Contribution Limit | $4,150 Self-Only $8,300 Family | $4,300 Self-Only $8,550 Family |

| HSA: Catch-Up Contribution Limit | $1000 | $1000 |

| HSA: HDHP Out-of-Pocket Max | $8,050 Self-Only $16,100 Family | $8,300 Self-Only $16,600 Family |

| HSA: HDHP Minimum Annual Deductible | $1,600 Self-Only $3,200 Family | $1,650 Self-Only $3,300 Family |

| Commuter Reimbursement: Parking | $315/month | - |

| Commuter Reimbursement: Transit | $315/month | - |

| QSEHRA | $6,150 Single $12,450 Family | - |

| EBHRA | $2,100 | $2,150 |

| Educational Assistance – Max Income Exclusion | $5,250 | - |

| Medical Mileage Rate | $.21 | - |

| Highly Compensated Employee Dollar Threshold | $155,000 | - |

| Key Employee Dollar Threshold | $220,000 | - |

Health Savings Account (HSA) contribution increases:

Significant contribution increases will allow employees to save more with their HSAs next year. The increases will take effect in January 2025 and are outlined in more detail in this IRS announcement article.