OOPM released for the 2023 plan year represents a 4.3% increase from OOPM for the 2022 plan year.

- Applies to: All states, Regulatory and compliance

The 2023 out-of-pocket maximum (OOPM) for health plans is $9,100 for single coverage and $18,200 for family coverage. The 2023 OOPM represents a 4.3% increase above the 2022 OOPM of $8,700 for self-only coverage and $17,400 for family coverage.

| OOPM for 2023 plan year | OOPM for 2022 plan year |

| Self-only: $9,100 | Self-only: $8,700 |

| Family: $18,200 | Family: $17,400 |

The annual OOPM requirement applies to most non-grandfathered group health plans, regardless of whether the plan is fully insured or self-funded (ASO). It does not apply to grandfathered, transitional Relief, and retiree-only plans. The OOPM includes copayments, deductibles, and coinsurance amounts associated with both medical and pharmacy-covered benefits.

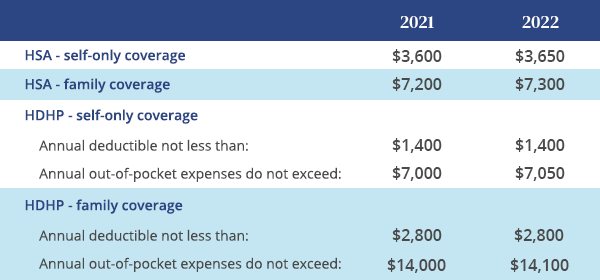

High-deductible plans with health savings accounts (HSAs) have limits that are different, including OOPM, deductible, and contribution limits. The Internal Revenue Service has not yet released final rules for 2023 HSA limits. Historically these are released in May. Please contact our office with any questions or concerns.