UPDATED MARCH 5, 2018. The IRS released Internal Revenue Bulletin 2018-10 indicating changes to the 2018 HSA Family contribution maximum. The family contribution maximum is being adjusted downward to $6,850 (from the previously announced limit of $6,900). This change may affect current and future contributions to HSAs. Please make any necessary adjustments to future contributions to accommodate the change. If you have already fully contributed for 2018, you may need to initiate an excess contribution removal.

The IRS initially released the 2018 cost-of-living adjustments for Health Savings Accounts (HSAs) in May 2017. However, the passing of the Tax Reform Bill led to a recalculation of the limits. HSAs are subject to annual adjustments. HSA limits consist of the contribution limits, minimum deductible requirements and maximum out-of-pocket limits.

2018 HSA Contribution Limit

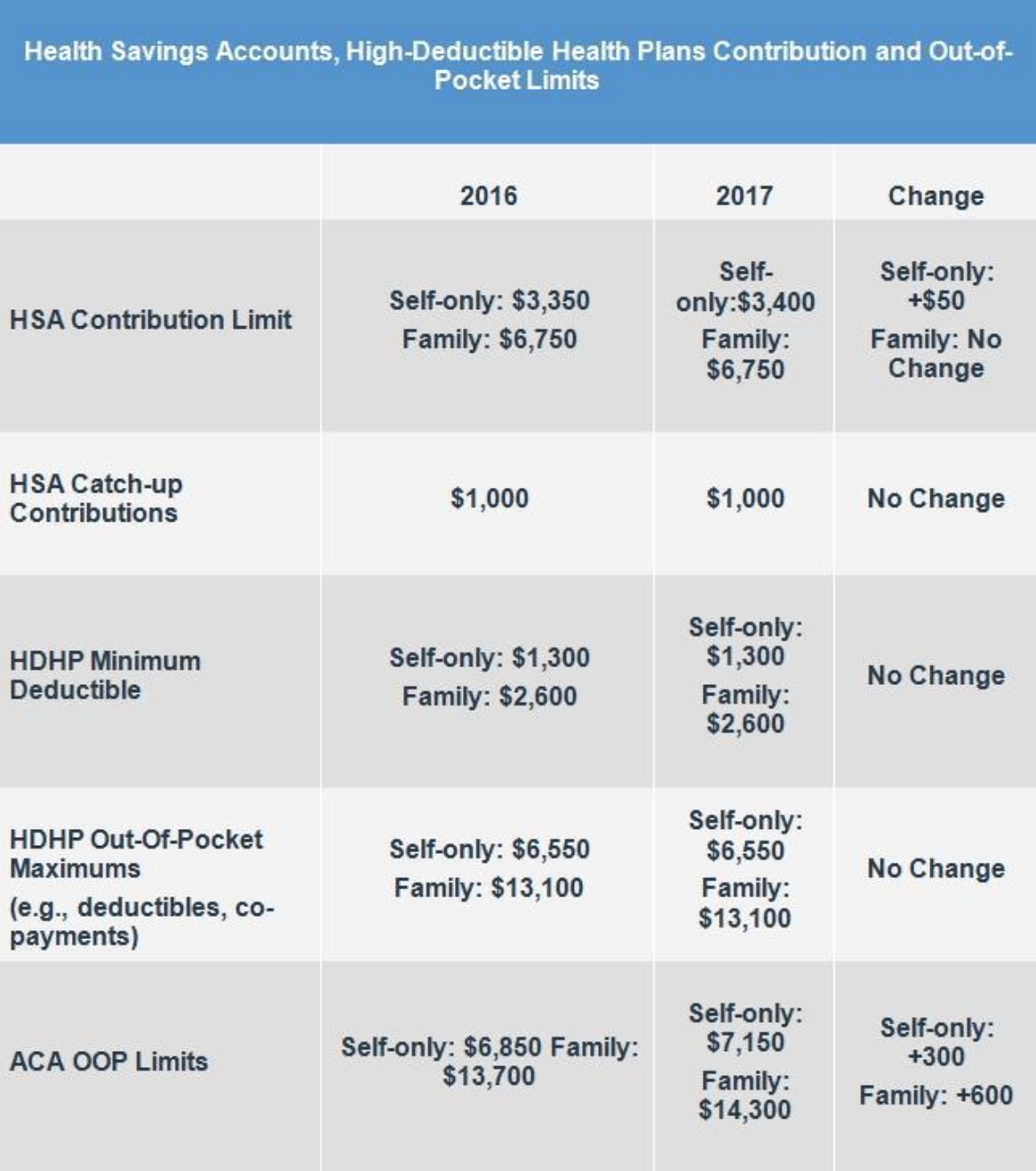

The HSA limits for contributions are set to increase in 2018. Individuals age 55 or older can continue to make an additional $1,000 catch-up contribution.

Individual: $3,450 (up from $3,400 in 2017)

Family: $6,850 (up from $6,750 in 2017)

HSA HDHP Requirements

The minimum deductible requirements are set to increase in 2018. For employers and individuals that are currently in a plan set at or near the minimum deductible limits, you will need to make adjustments to ensure your plan continues to remain HSA eligible.

Individual:

$1,350 minimum deductible (up from $1,300)

$6,650 maximum out-of-pocket (up from $6,550)

Family:

$2,700 minimum deductible (up from $2,600)

$13,300 maximum out-of-pocket (up from $13,100)

For individuals following the American Health Care Act, a bill has passed the House of Representatives and is up for consideration in the Senate. If the American Health Care Act became law, it would further expand these limits and make HSAs more flexible.