On April 9, 2018, the Department of Health and Human Services (HHS) issued final regulations and related guidance on Affordable Care Act (ACA) provisions including Essential Health Benefits (EHBs), out-of-pocket (OOP) maximums, and Marketplace updates and reforms. These regulations, generally effective for plans and plan years beginning on and after Jan. 1, 2019, largely mirror the proposed regulations issued Oct. 27, 2017.

The final rule affords greater flexibility to states for determining EHBs, reduces some regulatory requirements in the individual and small group markets and provides annual benefit provision updates. Additional guidance expands the individual mandate hardship exemptions available for 2018 for people living in states with federally-facilitated Marketplaces.

While the EHB benchmark plan changes most directly impact individual and small group plans, they will affect large group health plans as well. Otherwise, the final regulations are primarily focused on individual and small group Marketplace updates and reforms.

Essential Health Benefits (EHBs)

For plan years beginning on and after Jan. 1, 2020, the final rule allows states greater flexibility in selecting EHB benchmark plans. States are allowed to follow current rules and maintain 2017 benchmark plans, or they may select a new EHB benchmark plan annually from one of the following three options:

- Choose another state’s 2017 benchmark plan – allows states to select another state’s 2017 benchmark plan, and implement the plan benefits and limits to their own EHB standards, such as changing benefits with dollar limits to non-dollar limits.

- Replace one or more of the 10 required EHB categories of benefits under its current 2017 benchmark plan with the same categories from another state’s 2017 benchmark plan – giving states the ability to make precise changes to their 2017 benchmark plans at the coverage detail level. For example, State A may select the prescription drug coverage EHB from State B, which uses a different drug formulary.

- Otherwise, select a new set of benefits to become its benchmark plan – provided the plan meets other specified requirements.

The three options are subject to additional requirements, including two scope of benefits conditions. States must affirm that their new/modified benchmark plan provides a scope of benefits that are equal to, or greater than, the scope of benefits provided under a “typical employer plan,” and is no more generous than the most generous of a set of comparison plans. HHS released final guidance with the methodology states can use for comparing benefits. States have until July 2, 2018, to submit their 2020 EHB benchmark plan to the Centers for Medicare and Medicaid Services (CMS).

As a reminder, any health plan that covers EHBs must cover these benefits with no annual or lifetime dollar maximums. This includes both fully-insured and self-funded employer-sponsored plans.

2019 out-of-pocket (OOP) maximums

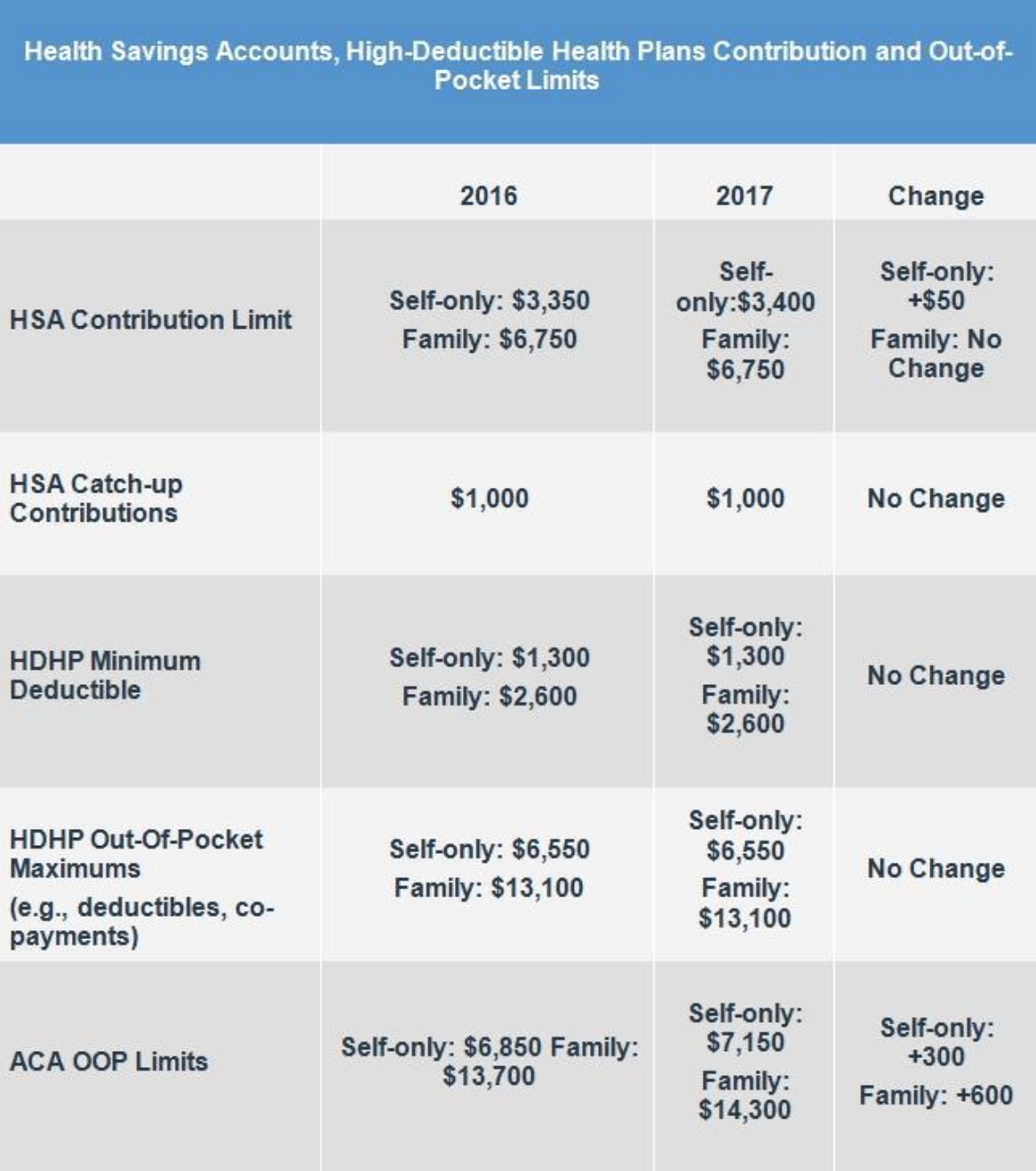

The 2019 OOP maximums increase to $7,900 for individual coverage and $15,800 for family coverage. These coverage limits apply to all non-grandfathered plans, regardless of size or funding type.

Marketplace regulations

The final rule also includes a number of provisions (effective Jan. 1, 2019) intended to strengthen the Health Insurance Marketplace, including:

- Deferring the network adequacy reviews for qualified health plan (QHP) certification to the states

- Loosening the audit process for agents, brokers, and issuers who participate in the direct enrollment process

- Updating the risk adjustment model for insurers with high-cost enrollees

- Modifying the requirements for Marketplaces to verify eligibility for, and enrollment in, qualifying employer-sponsored coverage

- Not specifying 2019 standardized plan options (known as simple choice plans)

- Updating special enrollment period (SEP) rules for coverage effective dates specific to SEPs that allow adding or changing dependents

- Adding a new SEP for pregnant women who were receiving coverage through the Children’s Health Insurance Program (CHIP) but lose that access

- Allowing Marketplaces to determine individual affordability exemptions based on affordability of the lowest-cost metal level plan available

- Allowing enrollees to request same-day termination of coverage

- Removing several Small Business Health Options Program (SHOP) requirements for online enrollment

Other market reforms

In addition to Marketplace updates, the final rules also modify other ACA provisions, including:

- Streamlining the rate review process for states and issuers, including when rates are posted by the states, increasing the threshold at which rate increases require review from 10% to 15%, and establishing a process for states to request a higher threshold

- Modifying the Medical Loss Ratio (MLR) rules, including simplifying quality improvement activity reporting requirements for issuers and establishing a process for states to use to request adjustments to the 80% MLR standard in the individual market

Review the information at these links for additional details:

- Read the Final Regulations

- Read the HHS Fact Sheet, which summarizes the regulations

Expanded individual mandate hardships

On April 9, 2018, HHS also issued guidance that expands individual mandate hardships. These additional circumstances are available to individuals who live in states that have federally-facilitated Marketplaces. While the individual mandate is effectively repealed beginning Jan. 1, 2019 due to the zeroing out of the penalty, eligible individuals may claim these hardships for the current calendar year or up to two years prior.

New hardship exemptions include people who:

- Live in a county, borough, or parish in which no QHP is offered

- Live in a county, borough, or parish in which there is only one issuer offering coverage and can show that the lack of choice resulted in them failing to obtain coverage under a QHP